安道尔税收居民身份认定规则和安道尔纳税人识别号编码规则

第一部分:安道尔税收居民身份认定规则

一、个人

根据2014年4月24日5号法案个人所得税的第8条规定,下列个人视为安道尔税收居民,并负有个人所得税纳税义务:

第8.1条

a)在一个公历年度内,在安道尔境内逗留超过183天的个人。在决定该个人在安道尔是否永久逗留时,临时离境应包括在内,除非其证明拥有其他国家或地区的税收居民身份。

b)主要停留地、活动中心或者重要经济利益的所在地直接或间接位于安道尔境内的自然人。

第8.2条

此外,若在法律上未分居的配偶和/或未成年子女通常居住在安道尔,则该个人也视为安道尔税收居民,有证据证明相反情形的除外。

第8.3条

对于跨境工作人员(如每天从西班牙或法国往来工作),如果其是被安道尔税收居民实体或者外国实体设立于安道尔境内的常设机构雇佣,不会被视为安道尔税收居民。

第8.4条

拥有安道尔国籍,且作为外交使团成员或国际组织的代表而常驻在境外的自然人,连同其在法律上未分居的配偶和18岁以下的未成年子女,视为安道尔税收居民。

二、实体

根据2010年12月29日95号法律有关企业所得税法的第7条规定,下列实体视为安道尔税收居民,并承担企业所得税纳税义务:

第7.1条

a)根据安道尔法律成立的实体;

b)在安道尔境内有登记办公地点的实体;

c)实际管理机构位于安道尔境内的实体。实际管理机构位于安道尔是指实体的重要管理地及主要生产经营控制地以及业务活动的开展地在安道尔境内。

d)将税收居所迁移至安道尔境内的实体,自根据商业法完成迁移之日起为安道尔税收居民。

三、不视为税收居民的实体

无

四、联系方式

Departament de Tributs i Fronteres/Tax and Borders Department

电子邮件:impostos@govern.ad

第二部分:安道尔纳税人识别号编码规则

一、纳税人识别号介绍

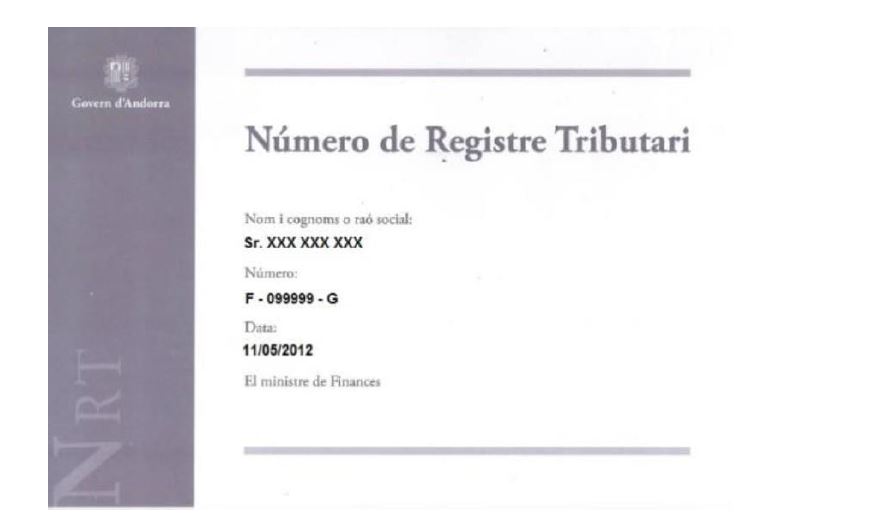

根据2014年10月16日21号法律第26(2)(b)条规定,应纳税主体在安道尔开展应税活动时,须通过相关税收系统取得并使用纳税登记号码(NRT)。税务管理法规第13(1)条规定:“个人、法人和其他纳税主体,无论是否为安道尔税收居民,在安道尔开展应税活动时,都须取得纳税登记号码。”

对于安道尔税收居民自然人,其纳税登记号码是以大写字母F(法规第14条)开头的行政识别号码。行政识别号码的使用与管理由2007年5月17日8号关于行政识别号码的法律作出规定。

对于安道尔非税收居民自然人,其纳税登记号码是以大写字母E(法规第15条)开头的行政识别号码。

对于法人或非法人实体,无论其是否为安道尔税收居民,税务机关将为其分配一个唯一的编号。除非实体的法律形式或国籍发生变化,否则该编号保持不变(法规第16条)。

http://www.impostos.ad/images/stories/docs/NRT_Passama.pdf

是否自动为所有税收居民发放纳税人识别号

个人,根据2015年2月11日颁布的税务管理法规第14条规定,自然人的纳税人识别号会在其取得行政识别号码时自动发放。

实体,根据2015年2月11日颁布的税务管理法规第17条规定,实体须申请其纳税人

二、纳税人识别号编码规则

| 格式 | 编码规则 | 持有者/注解 | 数字 |

| 自然人 | |||

| F-123456-Z | F+6位数字+1位校验码 | 税收居民以大写字母 F 开头的行政识别号码 | 0至699999 |

| E-123456-Z | E+6位数字+1位校验码 | 非居民 | 800000至999999 |

| 实体 | |||

| 法人 | |||

| A-123456-Z | A+6位数字+1位校验码 | 有限公司 | 700000至799999 |

| L-123456-Z | L+6位数字+1位校验码 | 私人有限公司 | 700000至799999 |

| E-123456-Z | E+6位数字+1位校验码 | 非居民法人 | 从0至999999 |

| 其他实体 | |||

| C-123456-Z | C+6位数字+1位校验码 | 合资安排 | 0至999999 |

| D-123456-Z | D+6位数字+1位校验码 | 公共实体/机构 | |

| G-123456-Z | G+6位数字+1位校验码 | 纳税群体 | |

| O-123456-Z | O+6位数字+1位校验码 | 集合投资计划 | |

| P-123456-Z | P+6位数字+1位校验码 | 商业组织/基金会 | |

| U-123456-Z | U+6位数字+1位校验码 | 准公共实体 | |

三、如何找到纳税人识别号

1.纳税识别卡(由税务与边境事务部门发放)

四、国内网站信息

无

五、联系方式

impostos@govern.ad

资料来源:

安道尔税收居民身份认定规则:

http://www.oecd.org/tax/automatic-exchange/crs-implementation-and-assistance/tax-residency/Andorra-Residency.pdf

安道尔纳税人识别号编码规则:

http://www.oecd.org/tax/automatic-exchange/crs-implementation-and-assistance/tax-identification-numbers/Andorra-TIN.pdf

Andorra - Information on residency for tax purposes

Section I - Criteria for Individuals to be considered a tax resident

Pursuant to article 8 of the Law 5/2014, of 24 April, on the Personal Income Tax, the following natural persons are deemed to be resident for tax purposes in Andorra, and therefore, liable to the Personal Income Tax (“PIT”):

Article 8.1

a)Natural persons staying more than 183 days in Andorran territory over the calendar year. In order to determine the permanence in Andorran territory, occasional absences are included, unless the taxpayer proves his residency for tax purposes in another countries.

b)Natural persons whose main base or centre of their activities or economic interests is situated, directly or indirectly, in Andorra.

Article 8.2

In addition, natural persons whose dependent not legally separated spouse and/or underage children are usually resident in Andorra are presumed to be tax resident in Andorra unless there is evidence to the contrary.

Article 8.3

Cross-border workers (workers commuting every day from Spain or France) and hired by entities resident for tax purposes in Andorra or by permanent establishments in Andorra of foreign entities are not deemed to be resident for tax purposes in Andorra.

Article 8.4

Natural persons with Andorran nationality, along with their spouses not legally separated and children under 18 years whose usual residence is abroad due to their condition of members of diplomatic missions or representatives at international organisations.

Section II - Criteria for Entities to be considered a tax resident

Pursuant to article 7 of the Law 95/2010, of 29 December, on the Corporate Income Tax, the following entities are deemed to be resident for tax purposes in Andorra, and therefore, liable to the Corporate Income Tax (“CIT”):

Article 7.1

a)Entities incorporated according to Andorran Law.

b)Entities with its registered office in Andorran territory

c)Entities whose place of effective management is situated in Andorra. For these purposes, an entity has its place of effective of management in Andorra where the key management and the control of the production of its activities and business are carried out in Andorra.

d)Entities which have transferred its fiscal domicile to Andorra, as of the date on which the transfer has been executed according to commercial law.

Section III - Entity types that are as a rule not considered tax residents

Not applicable

Section IV - Contact point for further information

Departament de Tributs i Fronteres / Tax and Borders Department

impostos@govern.ad

Andorra - Information on Tax Identification Numbers

Section I – TIN Description

Pursuant to article 26(2)(b) of the Law 21/2014, of 16 October, on the basis of the tax system, taxable subjects shall obtain and use a Número de Registre Tributari (NRT, Tax Register Number) when carrying out transactions involving Andorran taxation. Article 13(1) of the Tax Management Regulations establishes that “natural and legal persons and other taxable subjects, be they resident o non-resident, shall obtain a Tax Register Number (NRT) for their transactions involving Andorran taxation.”

For natural persons resident in Andorra, the NRT is the Número d’Identificació Administrativa (Administrative Identification Number, NIA), preceded by the letter “F” (article 14 Regulations). The NIA is regulated by Law 8/2007, of 17 May, on the regulation of the Administrative Identification Number.

For natural persons non-resident in Andorra, the NRT is the Número d’Identificació Administrativa (Administrative Identification Number, NIA) granted to them, preceded by the letter “E” (article 15 Regulations).

For legal persons and entities without legal personality, the Tax Administration will assign a unique number, regardless the fact that they are resident or not in the Principality of Andorra. This number is invariable unless there is a change of legal form or nationality (article 16 Regulations).

http://www.impostos.ad/images/stories/docs/NRT_Passama.pdf

Automatic issuance of TINs to all residents for tax purposes

Individual: yes 1

If no, instances where individuals are not being automatically issued a TIN are:

Entities (as defined by the CRS): no 2

If no, instances where Entities are not being automatically issued a TIN are:

1 TIN number for individuals is issued automatically when they obtain the Administrative Identification Number (NIA), pursuant to article 14 of the Regulations on tax management, of 11 February 2015.

2 TIN number for entities must be requested pursuant to article 17 of the Regulations on tax management, of 11 February 2015.

Section II – TIN Structure:

| Format | Explanation | Holder/Comments | Numbers |

| Natural persons | |||

| F-123456-Z | F + 6 digits + 1 control letter | Resident Número d’Identificació Administrativa (NIA) preceded by a letter “F”. | From 0 to 699.999 |

| E-123456-Z | E + 6 digits + 1 control letter | Non-resident | From 800.000 to 999.999 |

| Entities | |||

| Legal persons | |||

| A-123456-Z | A + 6 digits + 1 control letter | Limited company(societat anònima) | From 700.000 to 799.999 |

| L-123456-Z | L + 6 digits + 1 control letter | Private limited company(societat limitada) | From 700.000 to 799.999 |

| E-123456-Z | E + 6 digits + 1 control letter | Non-resident legal entities (including legal persons) | From 0 to 999.999 |

| Other entities | |||

| C-123456-Z | C + 6 digits + 1 control letter | Joint ownership arrangements (comunitats de béns) | From 0 to 999.999 |

| D-123456-Z | D + 6 digits + 1 control letter | Public entities/bodies | |

| G-123456-Z | G + 6 digits + 1 control letter | Tax groups | |

| O-123456-Z | O + 6 digits + 1 control letter | Collective Investment Schemes | |

| P-123456-Z | P + 6 digits + 1 control letter | Associations/Foundations | |

| U-123456-Z | U + 6 digits + 1 control letter | Parapublic entities | |

Section III – Where to find TINs?

1.Tax identification card (issued by the Tax and Borders Department)

Section IV – TIN information on the domestic website

No further information available

Section V – Contact point for further information

impostos@govern.ad