中国税收居民身份认定规则和中国纳税人识别号编码规则

第一部分:中国税收居民身份认定规则

一、 个人

在中国境内有住所,或者无住所而在一个纳税年度内在中国境内居住累计满一百八十三天的个人应认定为中国税收居民。在中国境内无住所又不居住,或者无住所而一个纳税年度内在中国境内居住累计不满一百八十三天的个人,为非居民个人。纳税年度,自公历一月一日起至十二月三十一日止。在中国境内有住所是指因户籍、家庭、经济利益关系而在中国境内习惯性居住。所谓习惯性居住,是判定纳税义务人是居民或非居民的一个法律意义上的标准,不是指实际居住或在某一个特定时期内的居住地。如因学习、工作、探亲、旅游等而在中国境外居住的,在其原因消除之后,必须回到中国境内居住的个人,则中国即为该纳税人习惯性居住地。

相关法律法规:

中华人民共和国个人所得税法第一条

中华人民共和国个人所得税法实施条例第二条

二、 实体

依法在中国境内成立,或者依照外国(地区)法律成立但实际管理机构在中国境内的企业,应认定为中国税收居民。依法在中国境内成立的企业,包括依照中国法律、行政法规在中国境内成立的企业、事业单位、社会团体以及其他取得收入的组织。依照外国(地区)法律成立的企业,包括依照外国(地区)法律成立的企业和其他取得收入的组织。实际管理机构是指对企业的生产经营、人员、账务、财产等实施实质性全面管理和控制的机构。

相关法律法规:

中华人民共和国企业所得税法第二条

中华人民共和国企业所得税法实施条例第三、四条

三、不视为税收居民的实体

合伙企业、个人独资企业不属于税收居民实体。合伙企业以其合伙人、个人独资企业以其投资人为纳税义务人。

根据CRS要求,税收透明体也属于应报送实体,例如合伙企业。

相关法律法规:

中华人民共和国企业所得税法第一条

财政部国家税务总局关于印发《关于个人独资企业和合伙企业投资者征收个人所得税的规定》的通知(财税[2000]91号)

四、联系方式

国家税务总局国际税务司国际税收征管协作处

北京市海淀区羊坊店西路5号

邮箱

eoicompetentauthority@chinatax.gov.cn

第二部分:中国纳税人识别号编码规则

一、纳税人识别号介绍

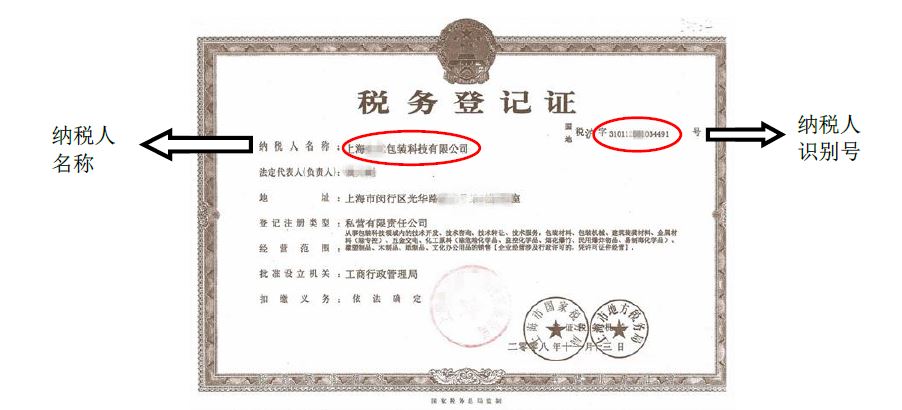

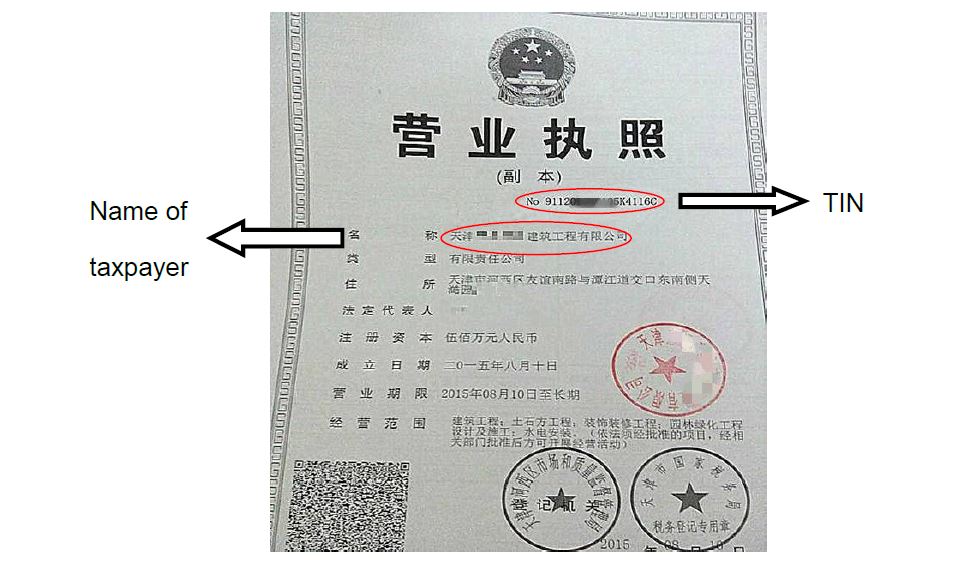

实体的纳税人识别号即统一社会信用代码。该代码通常显示在实体的登记证照上。比如企业的营业执照上包含统一社会信用代码。如果没有取得统一社会信用代码,纳税人识别号由税务机关根据有关编码规则发放。“三证合一”前,纳税人识别号为税务登记证上的15位数字代码。

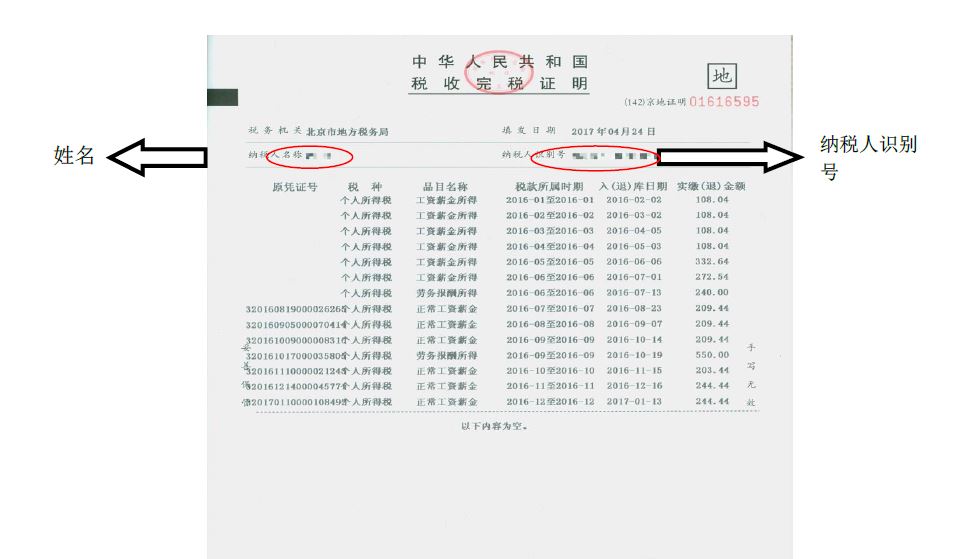

个人纳税人识别号根据其有效身份证明确定。以中国居民身份证为有效身份证明的个人,其纳税人识别号为其居民身份证号码。以护照或其他证据为有效身份证明的个人,其纳税人识别号由税务机关根据有关编码规则发放。

相关法律法规:

国家税务总局关于发布纳税人识别号代码标准的通知(税总发[2013]41号)

国家税务总局关于修订纳税人识别号代码标准的公告(国家税务总局公告2015年第66号)

国家税务总局关于自然人纳税人识别号有关事项的公告(国家税务总局公告2018年第59号)

是否自动为所有税收居民发放纳税人识别号:

个人:对于以中国居民身份证为有效身份证明的个人,

自动发放,因为纳税人识别号即是其居民身份证号码。对于以护照等其他证件为有效身份证明的个人,不是自动发放,其纳税人识别号于第一次纳税申报或者产生纳税义务之后发放。

实体:否。实体需要办理税务登记或者工商登记之后取得纳税人识别号。

二、纳税人识别号编码结构

不同类别的纳税人,纳税人识别号有所不同。

对于企业,旧的纳税人识别号由15位组成,新的纳税人识别号(统一社会信用代码)由18位组成。

对于个人,纳税人识别号根据其有效身份证明确定。以中国居民身份证为有效身份证明的个人,其纳税人识别号为其居民身份证号码。以护照或其他证件为有效身份证明的个人,其纳税人识别号由税务机关根据以下编码规则发放。个别地区曾用护照号作为外籍个人的纳税人识别号。

表1 编码规则表

| 纳税人类型 | 格式 | 说明 |

| 企业 | 999999999999999 (旧识别号) 999999999999999999 (新识别号) 99999999xxxxxxxxxx (新识别号) |

旧识别号为15位数字。新识别号为18位数字,有时最后10位出现字母,尤其是第9、10、13和18位。 |

| 以中国居民身份证为有效身份证件的个人 | 999999999999999999 99999999999999999x |

18数字或者17数字加字母“x” |

| 以中国护照为有效身份证明的个人 | C99999999999999999 C9999999999999999x |

首字母“C”+16位数字+1位检验码。 |

| 以外国护照为有效身份证明的个人 | W99999999999999999 W9999999999999999x |

首字母“W”+16位数字+1位检验码。 |

| 以军官证、士兵证为有效身份证明的个人 | J99999999999999 | 首字母“J”+16位数字+1位检验码。 |

| 以港澳居民来往内地通行证为有效身份证明的香港居民 | H99999999999999999 H9999999999999999x |

首字母“H”+16位数字+1位检验码。 |

| 以港澳居民来往内地通行证为有效身份证明的澳门居民 | M99999999999999999 M9999999999999999x |

首字母“M”+16位数字+1位检验码。 |

| 以台湾居民来往大陆通行证为有效身份证明的台湾居民 | T99999999999999999 T9999999999999999x |

首字母“T”+16位数字+1位检验码。 |

三、如何找到纳税人识别号

对于企业而言,纳税人在税务机关登记后取得税务登记证,登记证上标明纳税人识别号(旧)。新的纳税人识别号(统一社会信用代码)由工商部门发放,记载在营业执照上。对于以中国居民身份证为有效身份证明的个人,其纳税人识别号为其身份证号,在其身份证上显示。

企业:税务登记证(旧识别号)

企业:营业执照(新识别号)

以中国居民身份证为有效身份证件的个人:身份证

以护照或其他证件为有效身份证明的个人:完税证明

四、国内网站信息

更多信息可参见以下网站:

http://www.chinatax.gov.cn

五、联系方式

国家税务总局国际税务司国际税收征管协作处

北京市海淀区羊坊店西路5号

邮箱

eoicompetentauthority@chinatax.gov.cn

China - Information on residency for tax purposes

Section I - Criteria for Individuals to be considered a tax resident

In general,individuals who have domicile in China, or though without domicile but have resided for more than 183 days in total in China are deemed to be residents in China. An individual who has no domicile and does not reside in China, or has no domicile and resided in China for less than 183 days in a tax year is a non-resident individual. Tax year is the calendar year from January 1 to December 31. Domicile refers to habitual residence in China on account of domiciliary registration, family ties, economic interests. Habitual residence is a legal criterion whereby a taxpayer is defined and it does not refer to actual residence or residence of an individual for a particular period of time. For example, China is the habitual residence for an individual who should come back to reside in China after staying, working, visiting families, touring in a place other than China.

Relevant tax provisions:

Article 1— Individual Income Tax Law of the People's Republic of China

Article 2—Regulations for the Implementation of the Individual Income Tax Law of the People’s Republic of China

Section II - Criteria for Entities to be considered a tax resident

As a general rule, an entity is deemed to be a tax resident in China where it is incorporated in China in accordance with the laws of China or it is incorporated elsewhere but has the place of effective management in China. Above mentioned entity include enterprises, social organisations and other income generating organisations. Place of effective management refers to an establishment that exercises,in substance, overall management and control over the production and business, personnel, accounting, properties, etc. of an entity.

Relevant tax provisions:

Article 2 – Enterprise Income Tax Law of the People’s Republic of China

Article 3 & 4 – Implementation Regulations of the Enterprise Income Tax Law of the People’s Republic of China

Section III - Entity types that are as a rule not considered tax residents

The law of China does not treat sole proprietorship or partnership as a taxable person. Instead, taxable persons are the proprietors and partners rather than the proprietorship and partnership itself.

For the purposes of reporting under the terms of the Common Reporting Standard a reportable entity also includes entities that are typically tax transparent, e.g. partnerships.

Relevant tax provisions:

Article 1 – Enterprise Income Tax Law of the People’s Republic of China

Article 3 – Guidance on Individual Income Tax Administration of Sole proprietorship and Partnership (Caishui [2000]91)

Section IV - Contact point for further information

Chinese Competent Authority

Global Cooperation and Compliance Division, International Taxation Department,State Administration of Taxation

No. 5, Yangfangdian Xi Lu, Haidian District, Beijing, P.R.China

Email

eoicompetentauthority@chinatax.gov.cn

China - Information on Tax Identification Numbers

Section I – TIN Description

Entities: The TIN of an entity is the Uniform Social Credit Code with 18 digitals. Generally the Code is showed on the entity’s licence. For example, the TIN of a company is showed on its Business Licence. If no Uniform Social Credit Code was obtained, the TIN is a number assigned by local tax office according to relevant rules. For some old cases, the TIN is a 15 digital number showed on the Tax Registration Certificate.

Individual: TIN depends on its identification. For an individual using Chinese ID card as its identification, TIN is the ID number. For an individual using passport or other ID certificate as its identification, TIN is assigned by local tax office according to relevant rules. In some regions, passport numbers are also recognized as TIN for foreign individuals.

Relevant tax provisions:

Rules of Taxpayer Identification Number (Shuizongfa [2013]41)

Notice on Revision of Rules of Taxpayer Identification Number (Gonggao [2015]66)

http://www.chinatax.gov.cn

Notice on Taxpayer Identification Number for Individual Taxpayers

http://www.chinatax.gov.cn

Section II – TIN Structure

The structure of TIN varies depending on the types of taxpayer.

For entities, it consists of 15 characters (old TIN regime) or 18 characters (new TIN regime).

For an individual using Chinese ID card as its identification, TIN is its ID number which consists of 18 characters. For an individual using passport or other ID certificate as its identification, TIN is assigned in the following format. In some areas, passport numbers are also recognized as TIN for foreign individuals.

| Type of taxpayer | Format | Explanation |

| Entity | 999999999999999 (old TIN) 999999999999999999 (new TIN) 99999999xxxxxxxxxx (new TIN) |

For the old TIN regime, there are 15 numerals. While for the new TIN regime, there are 18 numerals with sometimes letters appearing in the last 10 characters, especially the 9th, 10th, 13rd and 18th. |

| Individual (Chinese ID) | 999999999999999999 99999999999999999x |

18 numerals or 17 numerals ID) followed by letter "x" |

| Individual (Chinese passport) | C99999999999999999 C9999999999999999x |

First character is"C" followed by 17 numerals or 16 numerals with a letter. |

| Individual (Foreign passport) | W99999999999999999 W9999999999999999x |

First character is "W" followed by 17 numerals or 16 numerals with a letter. |

| Individual (Soldier card) | J99999999999999 | First character is "J" followed by 14 numerals. |

| Individual (Mainland Travel Permit for Hong Kong Residents) | H99999999999999999 H9999999999999999x |

First character is "H" followed by 17 numerals or 16 numerals with a letter. |

| Individual (Mainland Travel Permit for Macau Residents) | M99999999999999999 M9999999999999999x |

First character is "M" followed by 17 numerals or 16 numerals with a letter. |

| Individual (Mainland Travel Permit for Taiwan Residents) | T99999999999999999 T9999999999999999x |

First character is "T" followed by 17 numerals or 16 numerals with a letter. |

Section III – Where to find TINs?

Taxpayer who registered with tax authority was issued a certificate of tax registration that contains its TIN. Under the new TIN regime, taxpayer who registers with industry & commerce authority will be issued a business licence that contains its Uniform Social Credit Code, which is also its TIN. The TIN number of individual is shown on its identification card.

For entity: CERTIFICATE OF TAX REGISTRATION (old TIN)

For entity: BUSINESS LICENCE (new TIN)

For individual using Chinese ID card as its identification: IDENTIFICATION CARD

Section IV – TIN information on the domestic website

For further information:

http://www.chinatax.gov.cn

http://www.gov.cn

No online checker is available now.

Section V – Contact point for further information

Chinese Competent Authority

Global Cooperation and Compliance Division, International Taxation Department, State Administration of Taxation

No. 5, Yangfangdian Xilu, Haidian District, Beijing, P.R.China

Email

eoicompetentauthority@chinatax.gov.cn